Using social conversations to uncover actionable brand messaging insights for a luxury Swiss watch manufacturer

Overview

When a Richemont Group-owned luxury watch manufacturer sought to better understand their target market and the competitive landscape at large via social conversation monitoring, they knew they needed a technology partner who could go beyond standard sentiment analysis to actually learn from social conversations. They wanted to draw conclusions and insights about who the target customer was, what their interests were, and how to impact the customers’ consideration and buying processes.

The manufacturer’s other requirement? The conversation monitoring must be completed in both English and Chinese — no easy feat for just any out-of-the-box monitoring tool to complete.

The manufacturer turned to us for our expertise in topic clustering and network analysis as well as its extensive experience in scanning, collecting, and analyzing public data across multiple languages.

The Challenge

The Swiss luxury watch manufacturer is still a relatively nascent name in the luxury watch landscape, a competitive space. As such, the brand is continually evaluating and refining its brand messaging and value proposition to ensure it is well-aligned with its target consumer.

One such method of product and marketing strategy refinement is via social media conversation monitoring: understanding how the brand is perceived, what conversations generate interest and demand for the brand, and who is having those conversations. However, the scale of the competitive landscape made manual monitoring for the brand too heavy of a lift, while the breadth of potential customers across countries and languages presented a challenge for more traditional monitoring tools.

Arboretica’s unique position at the intersection of artificial intelligence, natural language processing (NLP), and network analysis stood apart in the landscape of monitoring tools and platforms. That technological advantage, coupled with our experience with both Chinese language and social media platforms — approximately half of the brand’s consumers are Chinese — made it an ideal partner for the luxury watch manufacturer’s needs.

The Solution

Approach

Our approach entailed first focusing on researching topic clustering and network analysis, then moving into competitive analysis, client segmentation, and content discovery. To ensure optimal results, the process would begin and be refined within English-language Twitter analysis; when the brand and Arboretica were confident in the methodology, we would expand to Chinese social media analysis.

This approach would enable us to answer several key questions for the brand:

- What are people saying about the luxury watch manufacturer?

- What are people saying about competitor brands?

- Who is talking about the luxury watch manufacturer?

- Can customers be grouped by topic or interest?

- And ultimately, is the brand’s strategic roadmap aligned with the interests and persuasions of its target market?

Implementation

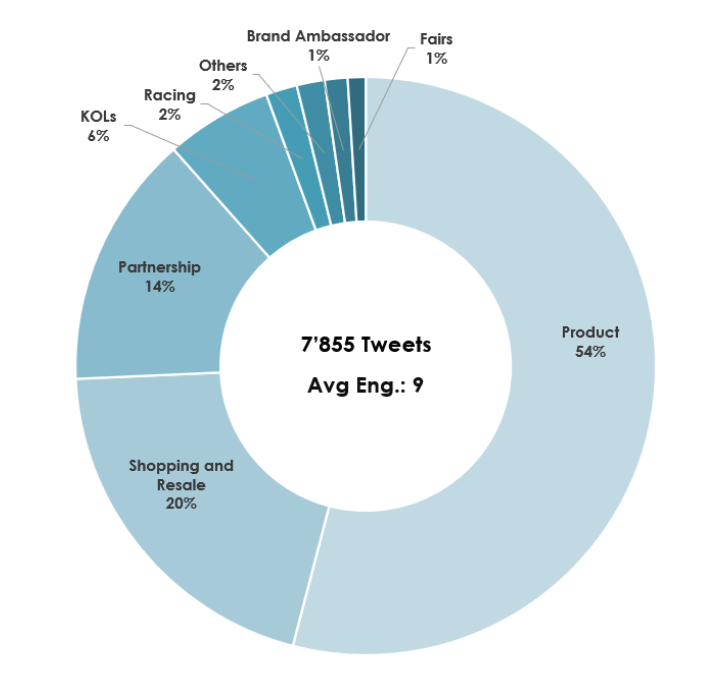

The scope of the analysis was extensive. Using proprietary technologies, Arboretica went back nearly four years to 2018 and collected nearly 500,000 tweets from more than 250,000 unique users discussing the luxury watch manufacturer and three of its main competitors.

Within the 500,000 tweets, we began by clustering topics: aggregating multiple pieces of content grouped by a shared topic and related subtopics. For each topic group, we analyzed the volume, the reach, the engagement, the number of users, the top languages, the top keywords and the top authors (users with most tweet engagements). We also identified sub-topics within each topic group, enabling the brand to dive one layer deeper in the conversations. This allowed us to gain a comprehensive overview of the brand and its competitors.

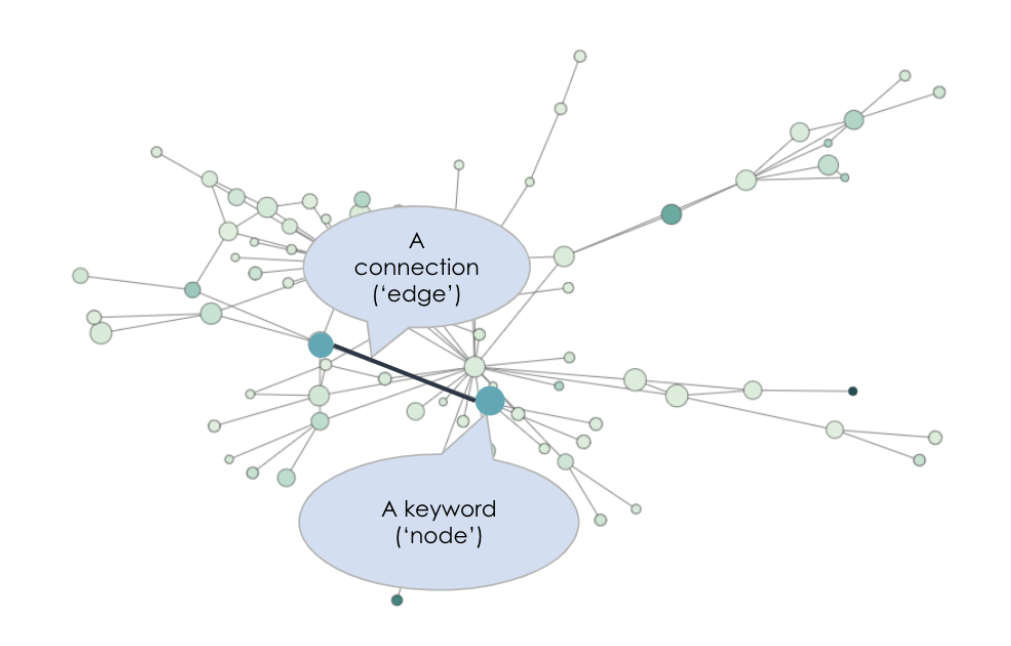

Network analysis soon followed. In network analysis, data is transformed into a network representation consisting of nodes (objects) and edges (relationships or connections between objects).

In this case, Arboretica used network analysis to understand what drives conversations about the watch manufacturer and to identify the terminology used by audiences. Our goal was to identify keywords that should be included in the brand communication messaging moving forward.

Through our analysis, we identified the central keywords of conversations. In other words, we found the keywords that bridge across different topic categories, and therefore resonate with audiences. The resulting map visually represents how the central keywords are associated with each other.

Both methodologies were applied to the brand and its competitors, giving Arboretica the ability to define the conversations and engagements with the brand as compared to competitor benchmarks.

Once the methodologies were tested and proven to be assessing the correct universe of data, they were expanded beyond Twitter and English-language evaluation to China’s Xiaohongshu (“Little Red Book”). With more than 300 million registered users and 85 million active users, Xiaohonghsu is known as China’s answer to Instagram. It is a platform where users and influencers share and discover content related primarily to beauty, health, and travel.

Analyzing content from Xiaohongshu meant that the Arboretica team followed the same methodologies, but with a subset of algorithms developed specifically to identify and analyze Chinese.

The Results

The findings were impactful from a brand messaging perspective.

The network and competitive analyses revealed that the brand’s content was more heavily product-centric than its competitors’, and that most conversations from highly influential users were focused on two key topics — neither of which was a brand message the manufacturer was currently emphasizing.

By contrast, the competitive analysis revealed that competitors were mentioned in a much wider range of conversation topics, from lifestyle interests to association with other luxury brands to niche influencer segments.

The network analysis also underscored the importance of high-profile partnerships to the brand. The brand had two existing marketing partnerships — both in the luxury automotive space — and through those partnerships gained a significant amount of earned media exposure and amplification of the watch manufacturer’s own content.

Following our data collection and analysis, we recommended pivots to the brand messaging and placement that could help better define the watch manufacturer’s identity to its target customer and its place in the competitive landscape, including:

- Shift messaging towards high-performing existing topics and away from ones that were not generating conversation.

- Recommend specific words and phrases to retire from and add to brand messaging.

- Start conversations about the product in association with a certain lifestyle.

- Start conversations about the product in association with other, non-competitive luxury brands.

- Start partnerships with new KOLs.

Does your organization need to monitor social media conversations? If so, contact us to see how we can help.